Jp Morgan Guide to Markets Year in Review

Monthly Market Review

Review of markets over the start quarter of 2022

01-04-2022

Paola Toschi

Afterwards an exceptional 2021, the start quarter of 2022 has been difficult for markets. Concerns over the economical implications of the Russian invasion of Ukraine and the potential need for a faster pace of involvement rate hikes to gainsay higher inflation, weighed on both equities and bonds.

Russia is a major energy and commodity producer and the escalation of tensions pushed energy and commodity prices to extreme levels, exacerbating the surge in inflation, supply chain disruption and the gamble to global growth.

Brent oil and natural gas prices were very volatile. They spiked early in March before falling back, with brent oil ending the calendar month at $103 per barrel and European gas prices at €121 per megawatt hour, up 33% and 55% respectively since the first of the year.

Adult marketplace equities recovered some of their losses to finish March upwardly about 3% merely were still down 5% twelvemonth-to-date (YTD). Emerging markets lost a further 2% in March leaving them down virtually 7% YTD. A new round of Omicron cases in China weighed on Chinese markets on top of the broader geopolitical concerns.

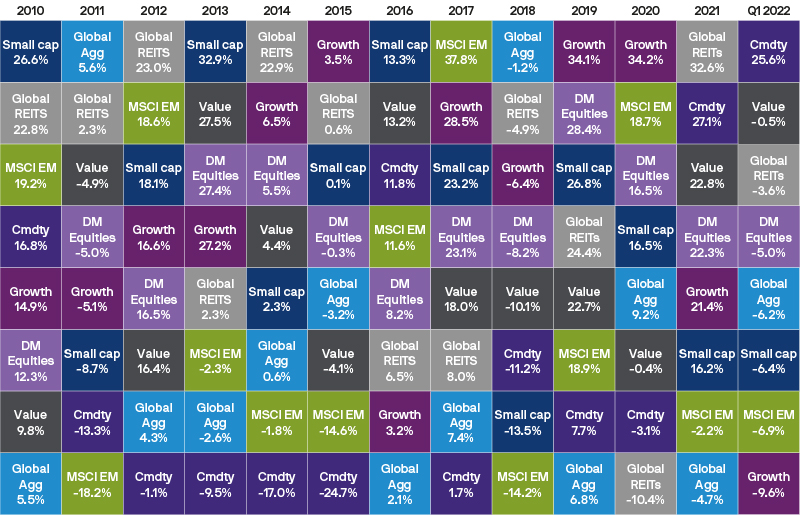

Showroom ane: Asset class and mode returns

Source: Bloomberg Barclays, FTSE, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. DM Equities: MSCI Earth; REITs: FTSE NAREIT Global Real Manor Investment Trusts; Cmdty: Bloomberg Commodity Index; Global Agg: Barclays Global Aggregate; Growth: MSCI World Growth; Value: MSCI World Value; Pocket-sized cap: MSCI World Modest Cap. All indices are total return in United states of america dollars. By performance is not a reliable indicator of current and futurity results. Data as of 31 March 2022.

Over the quarter, developed market value stocks were only down 0.five% while growth stocks brutal nearly 10%. This was partly due to the fact that 10-year Treasury yields reached 2.4%, up from just one.v% at the outset of the year, after the Federal Reserve (the Fed) delivered its first rate hike since 2018. The Global Aggregate Bond Alphabetize fell six.2% over the quarter.

Expectations for faster monetary tightening in the US also contributed to a rally in the dollar, which finished the quarter up nearly 3% against both the pound and the euro.

Monetary policy

The narrative that inflation was transitory began to change at the first of the year and over the quarter central banks became gradually more hawkish, driving bond yields higher. The start of the state of war betwixt Russian federation and Ukraine and the resulting commodity supply stupor poses a dilemma for central banks who are forced to cull between trying to tame inflation or support growth.

While acknowledging the uncertainties related to the geopolitical state of affairs and its economical implications, central banks have so far suggested that they view inflation as the more pressing problem to tackle unless the growth outlook markedly deteriorates.

Last February euro area inflation was revised up to 5.9% and inflation in the UK accelerated to half dozen.two%. In the U.s., inflation reached a twoscore-yr high of 7.9% and is expected to remain elevated over the coming quarters.

The European Central Banking concern confirmed that the tapering of the pandemic emergency purchase programme (PEPP) volition conclude in June and the asset purchase plan (APP) will gradually end over the 3Q22 but with the usual conditionality and information-dependency. President Christine Lagarde left the door open up to a first charge per unit hike this year that could arrive "some fourth dimension" later the end of asset purchases.

The Fed raised the target charge per unit past 0.25%, every bit expected, making it clear that further increases will exist appropriate. The median voting member now expects seven hikes this year, and four side by side yr, signalling that rates could finish this hiking cycle higher than the commission's perceived neutral rate of two.four%. The commission plans to reduce the size of its now $9.0 trillion balance sheet, which could exist announced "at a coming meeting".

Subsequently a first hike in December, the Banking company of England raised the policy charge per unit past 0.25% twice in the beginning quarter, reaching 0.75%. At the March meeting, the Banking company described geopolitical risks as having accentuated its prior expectations for weak growth and high inflation this yr. The Bank added that "monetary policy volition human action to ensure that longer-term inflation expectations remain well anchored".

The trend of policy normalisation was also pursued by some emerging market central banks, with Brazil, Taiwan, Korea and Hong Kong all announcing rate hikes.

In contrast to its global peers, the Bank of Japan stayed on concord, maintaining its current easing opinion and emphasised concerns regarding the touch on of the Russian federation-Ukraine situation on growth rather than aggrandizement, which in Japan remains low at around i%.

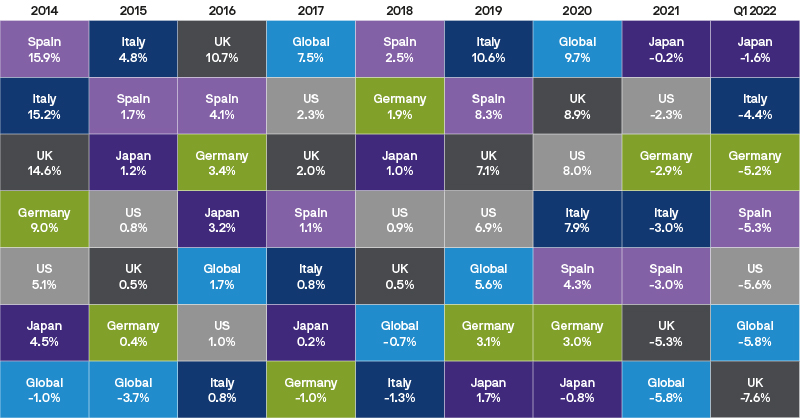

Europe

Europe is a huge importer of oil and natural gas from Russian federation, which makes the area highly vulnerable to the Russia-Ukraine disharmonize. The take a chance of a sizeable economic deceleration as a effect of a prolonged period of high energy prices could materialise in the region. However, it could also be mitigated by the loftier excess savings accumulated during lockdowns, healthy labour markets and fiscal stimulus.

Consumer confidence moved sharply lower in March, hurt past the surge in prices. Nonetheless, labour markets are nevertheless improving and wages are ascent. European institutions are discussing the launch of an free energy and defence fund and a new issuance of European bonds, which could be critical to cushioning sharply rise energy costs. Individual countries, such every bit Federal republic of germany, French republic and Italy, are likewise approving measures to absorb function of higher free energy bills for households.

Purchasing Managers' Index (PMI) business organisation surveys in March showed strong economical resilience, with the flash composite index in the euro area remaining comfortably in positive territory at 54.five. Industrial product remained stable for many European members with the exclusion of Italian republic which posted a drop of 3.4% in Jan that may reflect how component shortages and the free energy shock are starting to hurt manufacturing activity.

The European Committee appear ambitious plans to reduce imports of gas from Russia by two-thirds earlier the end of the year via more diversification, energy efficiency and by accelerating investments in wind and solar power plants. Despite this ambition, the March European union height in Versailles highlighted that there are few almost-term alternatives to Russian gas and that reducing European dependency on Russian gas requires a long-term strategy.

UK

The UK is less dependent on Russian energy imports but is a heavy user of gas and oil then is exposed to risks from persistently higher energy prices. The Chancellor appear a fiscal package of around 0.4% of GDP, for the period 2022/23 that will provide some support to household incomes in the face up of a significant purchasing power squeeze due to higher energy bills. Whether it will be enough remains to be seen.

The UK labour market is all the same showing signs of tightening with strong jobs growth in February. The unemployment rate fell to 3.ix% and wage growth was faster than expected.

The wink PMI concern survey was also amend than expected with the blended component showing a modest decline to 59.7, which indicates that the economy is currently withal growing at a good pace despite headwinds from higher energy prices. Nonetheless, consumer confidence fell sharply.

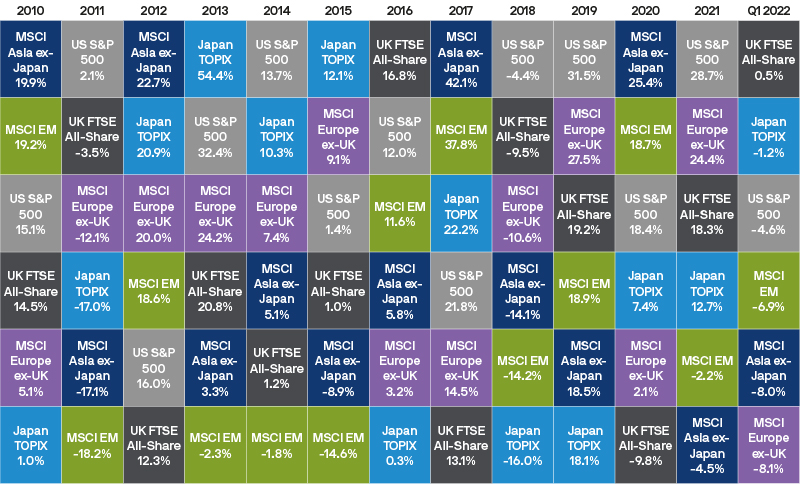

Showroom two: World stock market place returns

Source: FTSE, MSCI, Refinitiv Datastream, Standard & Poor'southward, TOPIX, J.P. Morgan Nugget Management. All indices are total return in local currency, except for MSCI Asia ex-Japan and MSCI EM, which are in The states dollars. Past performance is not a reliable indicator of current and future results. Data equally of 31 March 2022.

Showroom iii: Fixed income sector returns

Source: Bloomberg Barclays, BofA/Merrill Lynch, J.P. Morgan Economic Research, Refinitiv Datastream, J.P. Morgan Asset Management. Global IL: Barclays Global Inflation-Linked; Euro Gov.: Barclays Euro Aggregate Government; U.s. Treas: Barclays US Aggregate Government - Treasury; Global IG: Barclays Global Aggregate - Corporates; United states HY: BofA/Merrill Lynch US HY Constrained; Euro HY: BofA/Merrill Lynch Euro Non-Financial HY Constrained; EM Debt: J.P. Morgan EMBIG. All indices are full render in local currency, except for EM and global indices, which are in US dollars. Past functioning is non a reliable indicator of electric current and future results. Data as of 31 March 2022.

Us

Consumer sentiment deteriorated during the last quarter in reaction to college prices. All the same, the US labour marketplace remained robust. The February jobs report came in much improve than expected with total nonfarm payrolls comfortably surpassing consensus forecasts. The unemployment rate dropped to 3.8%, despite the labour force participation rate moving up modestly to 62.3%. Wage growth came in at 5.ane% twelvemonth-on-year.

Congress passed a spending neb to fund the federal government through September which, combined with concluding December'southward $2.5 trillion increment in the debt ceiling, eliminates the imminent hazard of a fiscal crisis.

Showroom 4: Fixed income authorities bail returns

Source: Bloomberg Barclays, Refinitiv Datatsream, J.P. Morgan Asset Management. All indices are Bloomberg Barclays criterion government indices. All indices are full return in local currency, except for global, which is in US dollars. Past performance is not a reliable indicator of current and future results. Data as of 31 March 2022.

Japan

Nippon introduced some gasoline subsidies that should assistance to back up household consumption through the energy price shock. The manufacturing sector continues to face supply constraints due to virus-induced factory shutdowns and persistent semiconductor shortages, especially in some areas like autos.

Cathay

The outset quarter of 2022 was tough for Chinese markets. The chief concern was related to a new outbreak of Omicron and the subsequent lockdowns in Shenzhen, Shanghai and other cities. Manufacturing plant shutdowns exacerbated global supply constraints in some crucial sectors.

More convincing economic stimulus measures announced by Chinese authorities during the National People'south Congress, a textile improvement in credit growth and the confirmation of a 5.v% growth target for 2022 brought dorsum some confidence to markets, supporting a rebound in onshore and offshore disinterestedness indices at the stop of March.

Russia

Difficult economic and financial sanctions were imposed on Russian federation by developed nations, including removing some Russian banks from SWIFT and imposing restrictions on the Key Bank of Russian federation'due south (CBR) international reserves. The CBR adopted extraordinary measures, increasing the policy rate to 20% and imposing capital controls to limit outflows. Despite that, the ruble complanate and the stock exchange was closed for ii weeks.

These astringent sanctions will inflict meaning impairment to the Russian economic system, which is expected to enter a deep recession, despite the fact exports of oil and natural gas mostly continued. Due to its high dependency on Russian gas, Europe avoided putting in place sanctions that could put imports of energy and related payments at run a risk. All the same the Biden administration, due to the modest dependence of the US on Russian supply, was able to ban imports of oil from Russia.

Showroom five: Index returns for March 2022

Source: Bloomberg Barclays, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management. Past functioning is not a reliable indicator of current and futurity results. Information as of 31 March 2022.

Determination

The upshot of the war in Ukraine remains highly uncertain. An escalation of tensions could go along to put upward pressure on energy and commodity prices, exacerbating inflation and supply chain constraints that already emerged mail pandemic, every bit discussed in our aggrandizement trilogy (Part 1 – Storm in the ports; Part 2 – The labour market is fundamental; Part iii – protect your capital) and putting global growth at risk.

However, geopolitical crises have ofttimes had a sharp but relatively short-term impact on markets and it is important to avoid the risk of panic selling and potentially existence whipsawed. One potential effective approach is to remain diversified and identify apparent long-term investment themes, avoiding emotional behaviour dictated by fright. The Asian decade and ESG investment themes are even so intact and could offer greater opportunities subsequently the recent drawdown in markets.

The energy crisis induced by this war volition move many governments to advance their energy transition plans, creating pregnant growth in the obvious beneficiaries from such a transition but likewise in some less obvious areas, as highlighted in our latest article: "A new super cycle – the clean tech transition and implications for global commodities".

Source: https://am.jpmorgan.com/gb/en/asset-management/adv/insights/market-insights/market-updates/monthly-market-review/

0 Response to "Jp Morgan Guide to Markets Year in Review"

Postar um comentário